Table of Contents

- Consumer Price Index of Indonesia: Inflation Remains Low Despite Rising ...

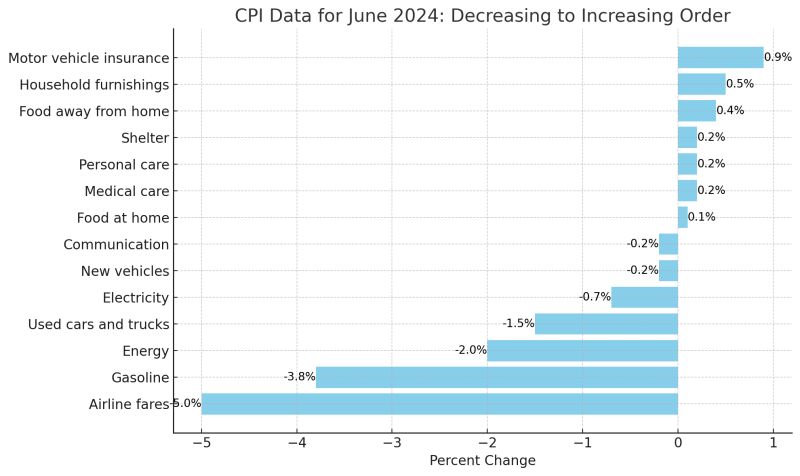

- Harmit Rajyaguru on LinkedIn: CONSUMER PRICE INDEX - JUNE 2024 The ...

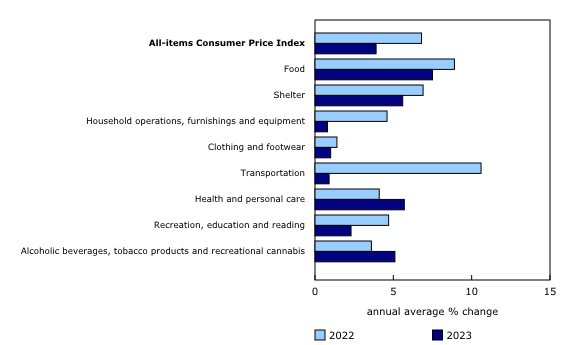

- The Daily — Consumer Price Index: Annual review, 2023

- The Effect of The Consumer Price Index On Inflation in Indonesia During ...

- Consumer Price Index: Rising Inflationary Pressures in Indonesia as ...

- consumer price index

- Consumer Price Index Malaysia January 2023 | PDF | Malaysia | Foods

- Consumer Price Index (CPI) of Indonesia; Back to Mild Deflation in ...

- Indonesia Consumer Price Index | Download Scientific Diagram

- All India Consumer Price Index For March 2024 - Jammie Chantalle

Understanding the Consumer Price Index (CPI)

CPI Forecast 2025/2026: Trends and Insights

Implications for Investors and Businesses

The CPI forecast for 2025/2026 has significant implications for investors and businesses: Inflation hedging: Investors can consider inflation-indexed bonds, commodities, or real estate to hedge against potential inflation risks. Interest rates: Businesses and individuals should prepare for potential changes in interest rates, which can impact borrowing costs and investment returns. Supply chain management: Companies can mitigate the impact of supply chain disruptions by diversifying their suppliers, investing in inventory management, and developing contingency plans. The CPI forecast for 2025/2026, as predicted by Trading Economics, suggests a moderate increase in inflation rates across the globe. Understanding these trends and insights can help investors, businesses, and individuals make informed decisions and navigate the complexities of the global economy. As we look ahead to the next two years, it's essential to stay vigilant and adapt to changing economic conditions to ensure long-term success.For more information on the CPI forecast and other economic indicators, visit Trading Economics. Stay ahead of the curve and make informed decisions with our expert analysis and data-driven insights.